Why Every Aussie Student Needs Financial Literacy

Let’s be real—money makes the world go 'round. Whether it’s buying textbooks, paying rent, or saving for that dream trip after Year 12, understanding how to manage your finances isn’t just helpful—it’s essential. Financial literacy is one of life’s fundamental skills, and now more than ever, schools need to bring it to the forefront of education.

At Manchester Global School (MGS), we reckon financial literacy is more than just a few lessons on dollars and cents—it’s a way of preparing our students for real-world independence. This blog dives into why financial literacy for students matters, how we’re raising the bar, and what you can do at home to support your child on the path to financial confidence.

The Importance of Financial Literacy for Students

Setting a Strong Foundation Early On

Learning how to handle money from a young age sets students up for success. By building a solid understanding of budgeting, saving, and investing, students become more confident in handling their own finances. And in the age of AI and automation, human smarts like financial literacy will be even more critical for standing out and staying secure.

At MGS, we embed these skills into everything from our classroom lessons to our hands-on projects, ensuring students don’t just learn theory—but also how to apply it.

Avoiding Debt Traps

One of the biggest issues facing young Aussies today is debt. Whether it’s Afterpay, HECS, credit cards or car loans, it’s easy to fall into a debt spiral without even realising it.

Financially literate students understand how to read the fine print, weigh up loan options, and manage credit responsibly. By the time they graduate, they’ll know the difference between good debt (like a home loan) and bad debt (like a high-interest credit card).

Real Skills for Real Life

Building Wealth Early

It might sound ambitious, but there’s no reason students can’t start building wealth while they’re still in school. Learning about compound interest, basic investing, and long-term planning means students can get a head start on creating financial security. At MGS, older students even participate in simulated stock markets and investing challenges to build these skills early—minus the risk.

Making Smart Decisions From the Get-Go

Financial literacy for students is also about making everyday choices. Things like:

Which bank account to open

How to split rent with flatmates

Whether that new iPhone is really worth a monthly repayment plan

It’s these little decisions that stack up. When students know how to evaluate financial options, they’re better prepared for adulthood—and far less likely to be caught off guard.

The Ripple Effect of Financial Education

Better Academic Performance

It’s true—students who know how to manage their money tend to do better in school. Why? Because they’re less stressed. When students aren’t worrying about finances, they can focus more on their learning, sports, and other areas of school life.

Career Readiness

From understanding superannuation to negotiating a salary, students who are financially literate walk into the workforce ahead of the game. They can compare job offers based on more than just the paycheque—factoring in benefits, tax, and long-term implications.

Personal Well-Being

The peace of mind that comes from knowing how to manage your money is hard to beat. Students who learn healthy financial habits early tend to experience less anxiety and greater control over their future.

What Every Student Should Know

Budgeting Basics: Learning to Live Within Your Means

Budgeting is the cornerstone of financial literacy. At MGS, students learn how to create budgets that reflect real life—whether that’s planning for a weekend activity, saving for a trip, or managing pocket money.

We make it practical too. From class projects to club budgets, students get hands-on experience with proposal writing, cost breakdowns, and fundraising plans. It's budgeting with purpose.

Understanding Credit and Debt

We don't just talk about credit—we break it down. Students learn:

What credit is

How interest works

The difference between secured and unsecured loans

The consequences of late payments or credit defaults

With that knowledge, they’re empowered to make smarter choices when they hit 18.

Saving and Investing: From Piggy Banks to Portfolios

At MGS, we introduce the concept of saving and investing through interactive activities like:

Simulated investment challenges

Digital piggy bank apps

Compound interest games

The aim? To help students see the value in putting money away now to enjoy more freedom later.

Planning for the Future

It might feel early, but we believe students can start thinking about financial goals now. We encourage things like:

Creating emergency funds

Understanding insurance basics

Setting long-term goals (like saving for uni, a car, or travel)

How We’re Teaching Financial Literacy at MGS

A Practical, Hands-On Approach

Financial literacy at MGS isn’t limited to a textbook. Students budget for camps, plan fundraising events, and manage club funds. It’s experiential learning, guided by supportive mentors.

We also tie financial topics into maths, business, and economics classes, ensuring students grasp the academic side as well.

Pocket Money With a Purpose

Our boarding students manage their own pocket money, using real budgeting tools and setting spending limits for their weekend trips. It’s a safe, mentored environment where they can learn from small mistakes without big consequences.

Learning Through Leadership

Through leadership programs and student-led projects, we encourage learners to take financial ownership. They’ll learn how to plan, budget, pitch ideas, and even manage grants or sponsorships.

Tips for Supporting Financial Literacy at Home

Encourage Conversations About Money

Start with open chats about family budgeting, bills, and savings goals. No need to share exact figures—just talk about priorities and how decisions are made.

Use Tech Tools

Budgeting apps like Pocketbook or Raiz (great for teens just starting to invest) can help make learning about money more engaging.

Let Them Make Mistakes

Give students a small budget to manage—maybe for their lunch, weekend fun, or school supplies. Let them make mistakes early, while the stakes are low.

Technology: A New Ally in Teaching Money Management

Online Tools and Budgeting Apps

Mobile platforms like Frollo, WeMoney, and MoneySmart’s TrackMySpend offer Aussie teens user-friendly ways to track spending and set saving goals.

Virtual Simulations and Investment Games

Students can test out real-world financial choices without the real-life risks. At MGS, we use stock market simulators and gamified challenges to help students learn the ins and outs of investing.

Challenges in Teaching Financial Literacy—and How We’re Tackling Them

Bridging the Resource Gap

Not every student comes from a home where money is openly discussed. That’s why we partner with financial professionals and community groups to provide diverse perspectives, free workshops, and tailored advice.

Reaching Every Learning Style

Our financial literacy programs are designed to be inclusive—using visuals, simulations, group discussions, and independent projects so every student finds a way in.

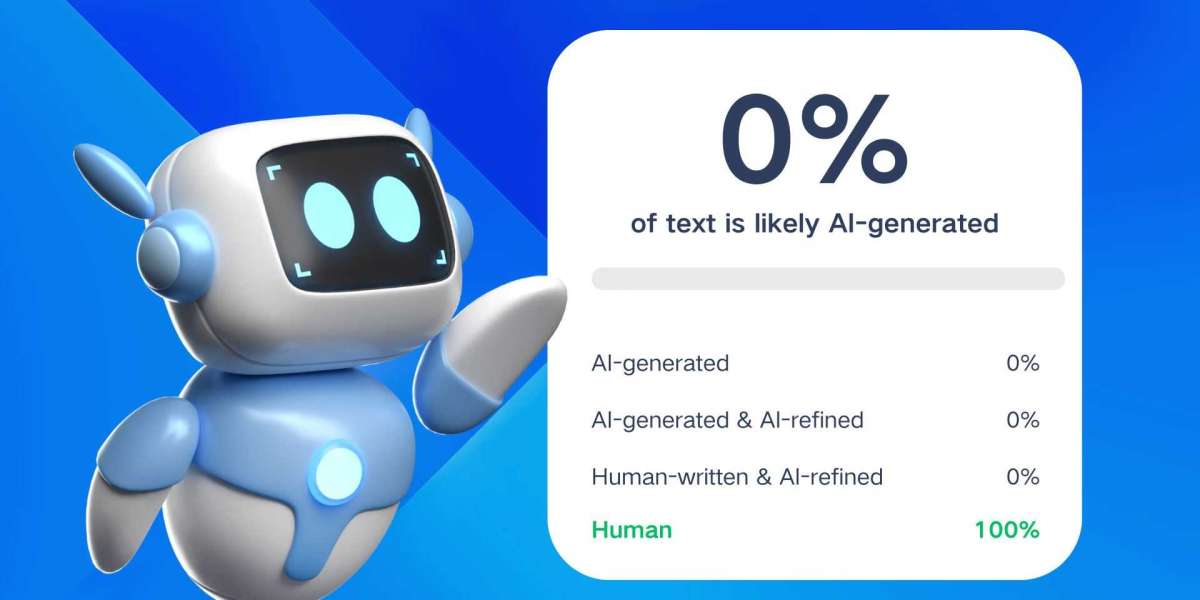

Measuring Impact: How We Know It’s Working

Tracking Student Growth

From pre- and post-assessments to self-reflection journals, we measure how students’ understanding and confidence improves throughout the year.

Real-World Outcomes

We also follow up with alumni to track behaviours like saving rates, student loan management, and financial planning to see long-term benefits.

Final Thoughts: Empowering the Next Generation

Financial literacy for students isn’t just a nice-to-have. It’s an essential tool for building confident, capable, and independent young adults. Whether it’s budgeting for a music festival, investing in shares, or planning their first big move out of home, students with strong financial skills are better prepared for whatever life throws at them.

At Manchester Global School, we’re proud to lead the way with a robust, practical approach to teaching financial literacy. And with support from parents, the wider community, and forward-thinking educators, we can ensure our students leave school ready not just to survive—but to thrive.

Frequently Asked Questions (FAQ)

1. What is financial literacy, and why is it important for students?

Financial literacy is the ability to understand and effectively use financial skills, such as budgeting, saving, investing, and managing debt. For students, it means gaining the confidence and knowledge to make smart money decisions—now and in the future.

2. At what age should students start learning about money?

Honestly, the earlier the better! Basic money concepts can be introduced in primary school, and by the time students reach secondary, they should be exploring budgeting, saving, and even investing. At MGS, we embed financial education across year levels through hands-on, age-appropriate activities.

3. How can parents support financial literacy at home?

Great question! You can:

Involve your child in household budgeting (even simple grocery planning)

Encourage saving by using jars or digital apps

Talk openly about money—spending, saving, and financial goals

Let them manage a small allowance to practise budgeting

4. What tools or apps are good for students learning money skills?

There are heaps of handy apps for Aussie students:

Spriggy (great for younger kids with pocket money)

Pocketbook or WeMoney (ideal for teens to track spending)

Raiz (an intro to micro-investing)

MoneySmart by ASIC offers free budgeting tools and learning resources.

5. Does financial literacy help with academic performance?

Absolutely! When students feel confident managing their finances, they’re less stressed and more focused. It promotes discipline, goal setting, and better time management—all of which flow into academic success.

6. What if a student makes mistakes with money?

That’s part of learning! It’s much better to make small, manageable mistakes now—like overspending lunch money—than larger ones later. At MGS, we offer a safe, supportive environment where students learn from real-life scenarios with guidance and reflection.

7. Do all students at MGS learn about investing and credit?

Yes—but at the right level for their age and experience. Younger students focus on saving and budgeting, while older students explore investing, credit scores, compound interest, and real-world financial planning.

8. Is financial literacy part of the curriculum or an extra subject?

At MGS, it’s woven into the curriculum and school life. From Maths to Business, Clubs to Boarding life, students practise money management through projects, planning events, and using budgeting tools—all backed by our IB framework.

9. Can financial literacy really help students prepare for life after school?

Definitely. Whether it’s managing a part-time job, paying for uni, or moving out of home, students who are financially literate are better equipped to navigate adult life with confidence and independence.